The Wisconsin Expenditure Restraint Program is the 2nd-dumbest municipal funding program and everyone involved should feel bad

What is the State of Wisconsin’s Expenditure Restraint Program and why is it stupid?

The 2026 city budget season is well underway in Madison, and one of the big themes this year is the Expenditure Restraint (Incentive) Program and how it threatens to blow a $7M hole in our 2027 budget. I’m not sure how much people really know what the ERP (now ERIP) is, and since I want to reference it in an upcoming post, I thought I’d write a warm-up blog post after a while away to cover it.

The ERP is a state program, and the headline of this blog post gave it away: I think it’s really, really dumb. Not quite “the levy limit is not adjusted for inflation” dumb, but it’s a close second. (Also, the state renamed the ERP to be the Expenditure Restraint Incentive Program, but I’m used to typing ERP and so I’m going to stick with that)

On the surface, it doesn’t sound that bad. The state says to municipalities, “If you don’t increase your budget too much each year, we’ll kick in some extra aid money.” Unfortunately everything after that is stupid.

The program’s been around since the 1990s, and it came about when municipal funding was very different in Wisconsin. Once upon a time, the state was on the hook to partially match whatever a city taxed and spent, and so the Expenditure Restraint Program was created as a carrot/incentive to “high tax” communities: slow down your budget growth and the state will kick in a little extra.

Of course, the state doesn’t fund cities like that any more and hasn’t for many years, but the ERP and its limits remain in place.

I wish I could blame the ERP on only the Republicans, but the Democrats have some blame here too. The ERP could have been reformed or eliminated when Democrats were in complete control for the 2009 budget, but they didn’t. The Republicans have certainly made municipal funding much worse with Act 10 in 2011 and subsequent changes during their full or partial control, and they’re still the main villains in this story, but when it comes to the ERP, a pox on both their houses.

Madison has qualified for an extra payment under the ERP since the beginning of the program. As for how much we get, I only went back to the 2011 budget, but we’ve gotten between $6M and $7M annually from it since then.

Here’s how it works.

On October 1st, the State will send a letter to every city telling them “Here is the limit to the growth in your city’s budget for next year if you want an ERP payment.” The formula is based on what inflation was from August to August, plus some portion of how much Net New Construction there had been in your city the previous year.

This makes it marginally better than the levy limits, which are strictly based on Net New Construction and that just pretend that inflation doesn’t happen and a city’s costs won’t go up from year to year. That’s still the dumbest thing in municipal finance. In fact, that’s one of the first dumb things about the ERP program. The ERP was originally created to help keep taxes under control, and today, the levy limits keep cities under a far tighter tax control than the incentives of the ERP.

But back to the process. Cities get their letters in the fall and know what their limit will be for the upcoming year, and put together their budget based on that limit. Cities submit their budget documents to the state in May of their current budget year, and from that, the state tells cities if they will get an ERP - in the subsequent year.

Just to be more clear on the timeline:

October 2025: Find out ERP limit for 2026 budget growth

November 2025: Write budget for 2026, aim to keep growth under ERP limit

May 2026: Submit budget document to state, get preliminary qualification for 2027 ERP payment and estimated amount later that summer

July 2027: After confirming actual 2026 spend, receive ERP payment.

So as the City of Madison is debating its 2026 budget, the ERP payment that will be part of the 2026 budget is not part of the debate. The 2026 payment is based on the 2025 budget, and so long as the city sticks to its 2025 budget through 12/31/2025, the City will get a payment in July of 2026. Whatever budget debate happens on the council floor in November of 2025, it will not affect the ERP dollars that will be part of the 2026 budget. Instead, the budget debate this year sets up the ERP payment for 2027.

And, some cities actually do debate “Do we want to get an ERP payment the following year?” Cities, especially smaller ones, will sometimes need to bump up their budget in a year, and for these smaller cities, the ERP payment may only be in the $100,000 range, so they might decide it’s more important to hire those 4 extra firefighters next year and skip a year of the ERP payment.

For Madison, however, the $7M we typically get is a big enough chunk of the budget that forgoing a payment in a year would be a challenge to make up.

With that background, let’s talk about why the ERP is dumb.

The ERP rewards cities that tax at a higher rate

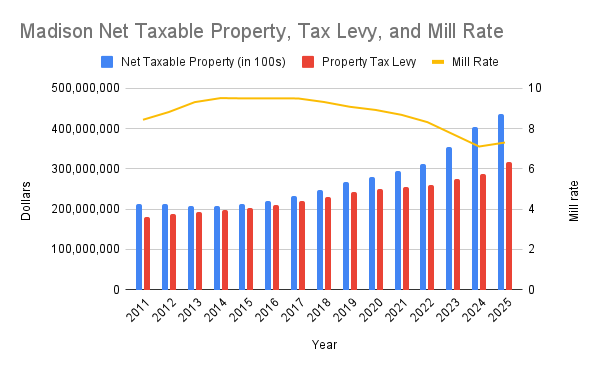

The way the ERP payment is calculated works like this: The state sets out a pot of money each year - about $58M dollars. The ERP payment is only available to cities that are “high tax”, which for the ERP means that their “mill rate” is at least 5 mills. (A ‘mill’ is tax per thousand, but it’s sometimes easier just to think of it as a tax rate of 0.1%, so a 5 mill rate means you pay 0.5% of your home’s value per year in taxes, or $5 for every $1000 of your home’s value. Most people have no idea what the mill rate is for any given year, though they likely know how much they paid in total for property taxes last year.)

For the ERP, cities get more ERP aid the more their mill rate is over 5 - a city with a tax rate of 10 mills has an “excess mill” of 5, and a city with a mill rate of 6 has an “excess mill” of 1. The ERP then calculates how much of a city’s levy is because of the “excess mill” - if your city is only 1 mill over, you only get 20% of your levy as “excess levy”, if your “excess mill” was 5 because your original mill rate was 10 mills, you get to count 50% of your levy as “excess levy”

Then the ERP calculates the total of all “excess levy” in the state, and calculates what portion of the “excess levy” is because of your city, and your city gets the part of the ERP pot of money in that same proportion. So two cities might both put in $1M of “excess levy” to the statewide total but the city that did it with a rate of 6 mills gets half of what the city that did it at a mill rate of 7 (and hence had 1 ‘excess mills’ compared to 2 ‘excess mills’)

You can argue that providing tax relief to high tax communities is in fact a good thing, but for reasons we’ll get to later, the GOP has broken municipal finance so badly in Wisconsin that this formula is the wrong way to do it.

The ERP hasn’t been funded properly in a generation

The 2025-2027 state budget sets aside $58M for each year for the statewide ERP payment pot of money.

The 2003-2005 state budget also set aside $58M for each year of the statewide ERP payment pot of money.

That’s right, the ERP payment hasn’t been adjusted since before most players on the Badgers football team were born.

The actual amount that cities get per year from the ERP has been relatively stable, because budgets grow at about the same rate. In 2011, Madison got about $6M in ERP, and in 2025, Madison got about $6.9M from the ERP, down from $7.4M in 2023.

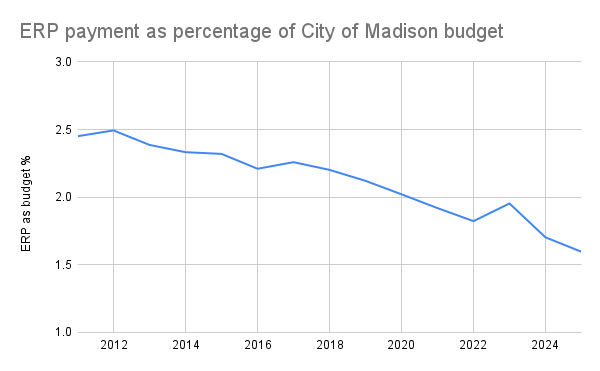

But, as a proportion of the overall City budget, the ERP in 2025 is only worth 65% of what it was in 2011 - the ERP payment was 2.5% of the 2011 budget, and the ERP payment is only about 1.6% of the 2025 budget.

The budget the ERP applies against counts nearly all funding sources, not just property taxes

The ERP looks at the increase of a city’s ‘General Fund’, not just property taxes. So if your city gets extra aid from the State for road construction, or more support from the Feds to support a homeless shelter, that gets counted against your budget for the expenditure restraint program. Thankfully it does not apply to debt service, but otherwise the list of exceptions to what doesn’t count towards the ERP limit is very small.

It also only applies to the ‘General fund’ and not to other funds. In Madison, that means things like the Wheel Tax don’t get counted against the ERP limit, because the Wheel Tax gets deposited into the Transportation Fund, along with other funding sources like Metro fare collections. Property taxes get counted no matter what fund they’re put into, however.

(And there’s a limitation on playing too many accounting games, you can’t just make up funds willy-nilly. So, we can’t put money into ‘Mayor Satya’s Pizza Party Fund’ and shield it from the ERP limits)

Governor Evers has proposed policy changes in his budgets that would fix this madness, and not penalize cities that get external funds for their budget, but the cranks in the GOP are not interested in good government and throw out anything he proposes automatically, so the broken system continues.

It did get so bad in 2022 and 2023, with so much Federal funding from COVID and changes to the State shared revenue funding that even the GOP realized that something needed to be done, but rather than fix it, they kicked the can down the road. The 2023 budget said “If you’re scheduled to get a 2024 payment, you automatically get a 2025 payment, same as you did in 2024. We’ll call that a ‘jubilee year’ and reset everyone’s budget to the new levels.”

So, besides screwing over any city that didn’t qualify for a 2024 payment but would have qualified for a 2025 payment, the budget didn’t try to fix the system, just papered it over for a cycle. It is just exasperating how little the GOP-controlled state legislature does to solve problems.

Act 10 will eventually drive growing and thriving cities out of the ERP program

Act 10 is crushing cities, ignoring inflation and limiting levy growth. If the GOP wanted to control municipal budgets, and make “government small enough to drown in the bathtub” as one particularly vile conservative is famous for saying, they couldn’t have done it better with Act 10. Act 10 really makes the ERP program obsolete. If the goal was to limit property tax growth, the sticks of Act 10 do that far harsher than carrots of the ERP.

However, despite the GOP’s best efforts, communities in Dane County are still growing and thriving, so much so that Madison and surrounding communities are in a housing crisis. One way the crisis is felt is sky-rocketing property valuations, pricing people who would like to move and live in Madison out of the area. Ideally we’d be building enough housing that our total property values would be growing because we’re adding more units, and not just making existing units more valuable, but at least rising values mean that people still want to live here.

Of course, the property tax side of the housing crisis is more nuanced, and rising property values do not translate directly into more funding for cities. If your home’s property value goes up, it does not mean that you will pay more in property taxes. The City levies a fixed amount for the entire city - $318M in 2025 - and the portion of that $318M you pay for property taxes depends on how much your home is worth compared to your neighbors. If their house went up more in value than yours did, you’ll pay a lower portion of the overall citywide taxes this year, even though you may still pay more overall than you did the year before.

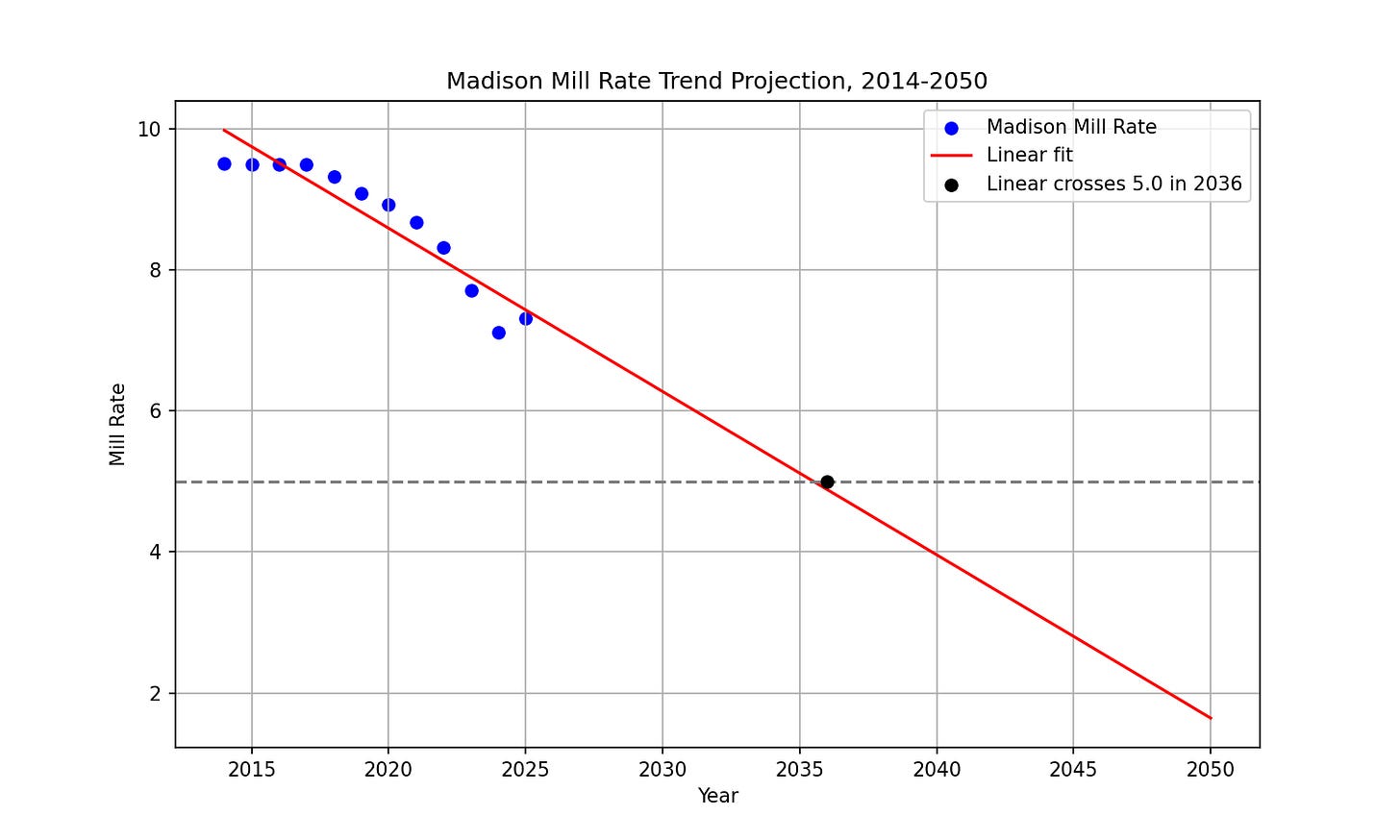

Because Act 10 keeps a vice grip on the levy and city funding, and the housing crisis is driving property values up at a very high rate, the mill rate - the value of all property in the city divided by the levy - is dropping fast in Madison. In 2014, the mill rate was 9.5. In 2024, the mill rate was 7.1. Property taxes are up from 2014, of course, but the rate has gone down. That’s part of why nobody knows or really much cares what the mill rate is any given year, except for city finance staff.

But of course since the ERP is a dumb program, it’s built around the mill rate.

Cities only qualify for the ERP if the mill rate is above 5 mills. In Madison, I project that the mill rate will fall below that in 2036, and Madison will no longer qualify for the ERP.

(The chart below shows a line fitted to the mill rate from 2014 onwards. That’s cherry-picking the data a little bit, but housing and markets were very weird for a few years after the Great Financial Crisis, so I’m starting at 2014 to put all of that behind us. The mill rate went up in 2025 because of the one-time $22M jump in the levy after the 2024 operating referendum but I expect it to start going back down again. This is only the City portion of the levy and not the county, schools, and MATC)

So the ERP is likely to be irrelevant for Madison within about a decade. For other cities, it may be much faster. Fitchburg’s mill rate has been dropping fast, it was 7.93 in 2022, 6.73 in 2023, 6.72 in 2024, and 5.8 in 2025. Fitchburg’s operating referendum failed to pass so their levy growth was not as fast as Madison’s in 2025. Property assessment in Fitchburg is not as robust as Madison’s and tends to have bigger jumps every few years, so it may not be in 2026, but it seems likely that soon Fitchburg will no longer qualify for ERP payments just based on their mill rates. (Fitchburg is less dependent on the ERP payment than Madison is and should be in a better position to manage it)

Will the Democrats fix this?

It’s important to remember that the ERP is a program under the control of the Wisconsin Legislature, and hopefully there will be changes there starting in January of 2027. Should Democrats take back at least one house, and ideally both, the prospects for change get much better, and hopefully combined with a Democrat following Tony Evers, we will see a rethinking of how municipalities are funded in Wisconsin. The over-reliance of the property tax combined with the strict limits forced on cities with the levy limit have been a disaster, and the whole system needs to be thrown away and recreated, and the ERP should get tossed as well. Hopefully the new system will be more fair to the City of Madison.

The Common Council will create a budget for 2026, setting up an expected ERP payment for July of 2027. It is conceivable that the payment in July of 2027 never happens, because the legislature redesigns the ERP program before the payment goes out. Indeed, if the City wants to be bold and take a major risk, they can bet this will happen and ignore the ERP limit when putting together their budget, counting on the future legislature to provide replacement funds in the new system.

I would not advise that, of course, and I assume the Council will put together its 2026 budget assuming the 2027 ERP payment will work as it has in past years.

But among the many reasons I am voting for Democrats in 2026 is that I’m confident they’ll fix this nonsense, and finally close down the long-obsolete Expenditure Restraint Program.

Data for graphs:

(Scroll it horizontally to see more years. Embedded thanks to the good folks at DataWrapper)

Further reading:

DOR report on the Expenditure Restraint Program:

https://www.revenue.wi.gov/DORReports/erp2024.pdf

Legislative Fiscal Bureau paper:

City of Madison 2026 budget outlook